Blockchain overview: Ethereum

Introduction

From sufficiently long distance Ethereum and Bitcoin look very similar. They both:

- are cryptocurrencies

- use Proof Of Work consensus algorithm (and hence mining).

Look closer and you will find the first and the biggest difference: the attitude of core developers. Bitcoiners are very conservative and they don’t break backward compatibility. Ethereum developers are more open-minded and risky persons. They are in constant search for new features and they deploy new stuff even if it requires their users to update client software.

Without considering human factor (or developers factor, not sure whether all developers are ordinary humans), the biggest difference is that Ethereum implements 2 applications in the single system. Remember my point of view on Bitcoin? Bitcoin is a distributed banking-like application (a cryptocurrency). Ethereum implements

- a banking-like application (a cryptocurrency)

- a programming language interpreter.

Interpreter

The traditional financial system is more complex than just moving money between accounts. There are regulations and each business involves relationships with companies and people. People sign contracts like “We will pay you XXX if you do YYY but the government will punish you if you fail to do YYY”. Contracts are enforced by 3rd parties like government institutions. In the spirit of cypherpunk, Ethereum provides a solution for implementing contracts and regulations in purely electronic form without government institutions.

There are several possibilities how we can implement contracts using blockchain.

- We (blockchain developers) can guess which kinds of contracts are useful and implement them directly inside blockchain code. In this case transactions format should provide fields to represent usage of available contracts.

- We can make blockchain scriptable and let users define their own contracts. Scripts could be installed separately from transactions or listed inside each transaction.

Ethereum follows the 2nd path. In contrast with Bitcoin, Ethereum scripts are Turing complete, which means they can compute everything which can be computed (no offense for such definition) and one can write a program which never terminates. Also, Ethereum script can be associated with an account, or in other words, it can be “installed” into blockchain. After installation scripts live their own digital life. Script execution can be triggered directly by a transaction from a “real” user, or by a message from another script.

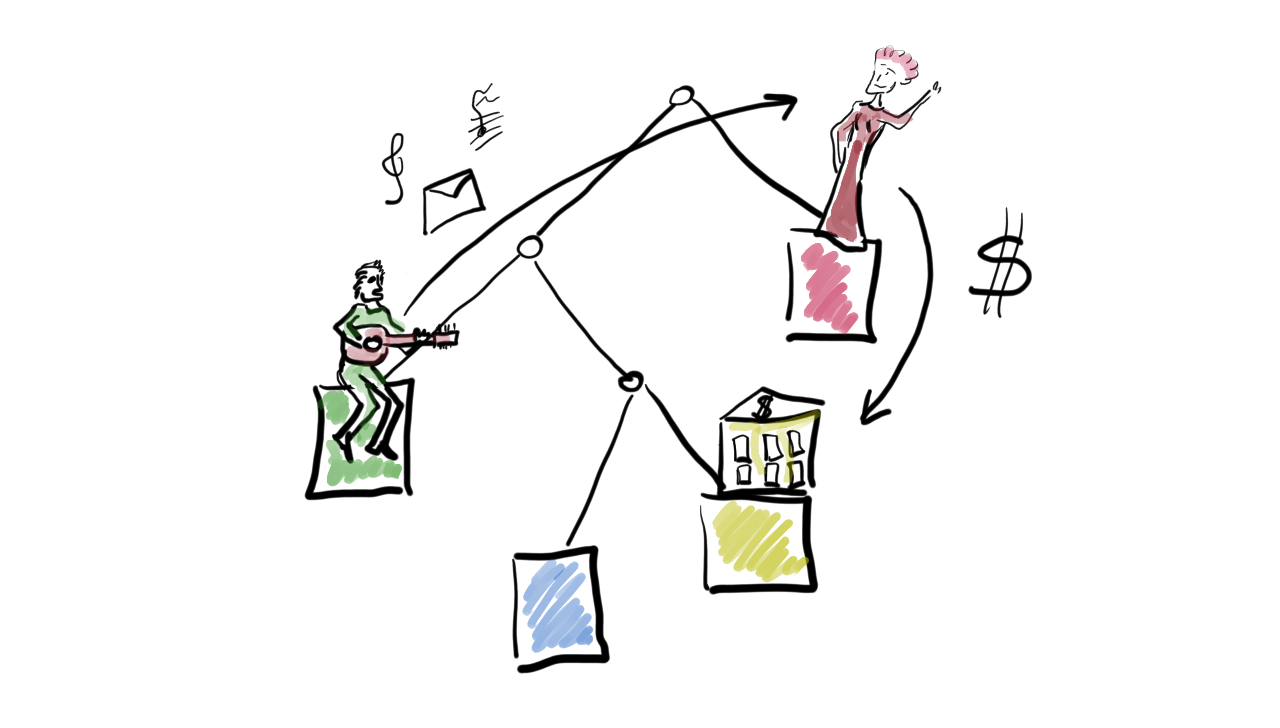

These Blockchain-based contracts are called smart contracts, and smart contracts are the main innovation of Ethereum. My intuition for smart contracts is that there are independent actors (or agents) stored in state. Users can wake up actor by transaction and then actor can read state, send messages to other actors and write data into the state. This is a cool idea which allows implementing some canonical behavior in code so that no one can affect that behavior by threats or bribes. This direction of thoughts leads to the ideology “Code is a law”.

Distributed virtual machine

In a broader sense, Ethereum is a distributed virtual machine build on top of the blockchain. “Virtual machine” here means the same thing as Java Virtual Machine. It’s just a program which executes other programs. Blockchain means resilience to Byzantine failures, immutable history, and so on.

I think distributed general purpose virtual machine on top of blockchain is an absolutely beautiful idea. Just think: you can ask the system to run your code and you don’t worry about infrastructure and probably you don’t worry about costs. Just let your customers pay for computations required to serve their needs. Don’t think about CDNs: your code automatically deploys to every region in the World. Don’t think about scaling, the system can automatically leverage thousands of machines. Brilliant idea. With such technology, you will get rid of your inner system administrator and you will become the pure developer. This technology will purify you. Just imagine... Pure programmer. Clean.

Is Ethereum general purpose enough to satisfy my dreams? From one side, Ethereum virtual machine is Turing complete. From the other side, set of exposed APIs and performance of Ethereum virtual machine dramatically limit its applications. It’s not general purpose enough even for everyday programming. But I like to think about blockchain from that angle. Modern blockchains are limited but I hope that after several iterations people will figure out how to implement distributed resilient general-purpose high-performance virtual machine. And pure programmer will be born.

One important remark. Blockchain nature also applies to scripts. This means:

- malicious node can’t forge wrong execution results, there is guarantee that each script will be executed properly;

- to satisfy previous property, each full node executes all scripts (there are ideas to optimize this, but nothing was deployed so far).

Cryptocurrency

One of the main ideas of Bitcoin is that most users will obey rules because there are incentives to obey the rules. A user who plays by the rules will obtain more money than the one who breaks the rules. The same applies to Ethereum but there are few more details which arise from Turing completeness of its scripting language.

Similarly to Bitcoin, each transaction is “replayed” (validated) on each full node. But validation of Ethereum transaction means the execution of arbitrary scripts which can eat a lot of CPU. One even can write an infinite loop in Ethereum scripts, how Ethereum ensures validation process will terminate? The issue is solved by right incentives. Execution of each instruction in Ethereum script costs money (it’s a transaction creator who pays). So infinite loop costs an infinite amount of money and hence impossible. Clearly, with such incentive, programmers are motivated to write short programs and it also prevents abuse of Ethereum scripts.

This pattern of combining cryptocurrency with other application is common in blockchain world. For example, there is a social network where you pay to create posts. Usually to use an application coupled with cryptocurrency user spends that currency. This is a neat way to pay for the service and to prevent abuse. Kind of digital symbiosis.

Other innovations

State organization

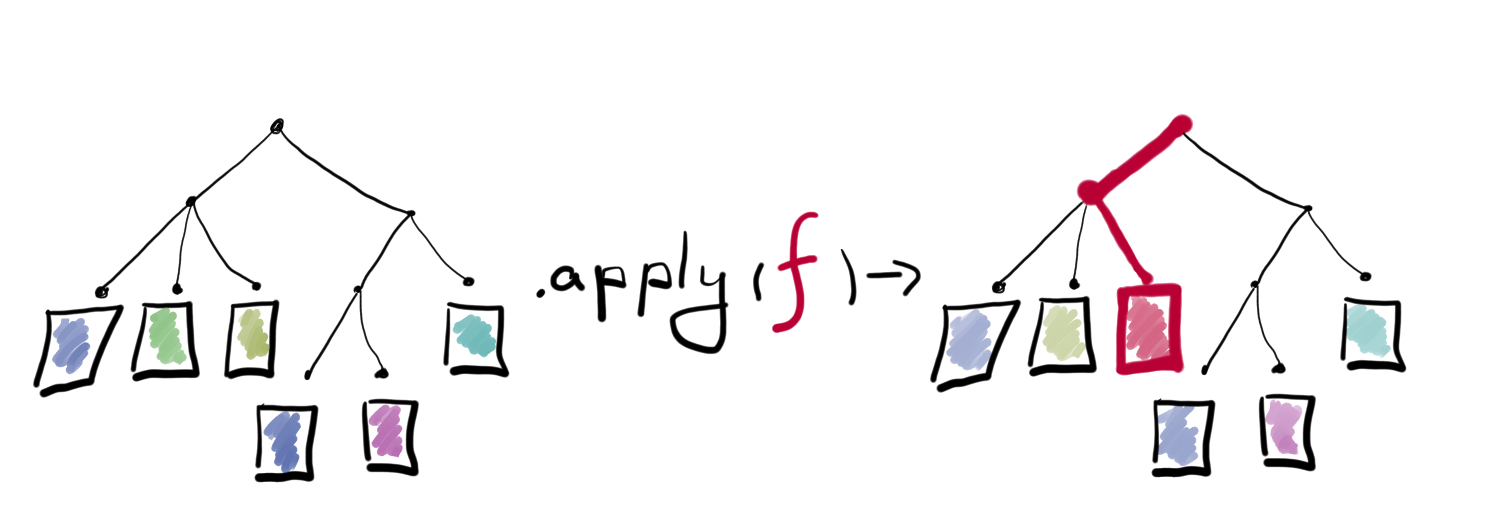

Ethereum organizes history differently compared to Bitcoin. It explicitly stores state in each block. To reduce storage consumption Ethereum represents the state as a tree data structure (actually as a trie). The main idea here is that state transformation usually changes only small part of the state which is a small subset of nodes in the tree. The new state can use almost all nodes from old one except for root node and several other nodes which locate on the path from the root to changed nodes. In fact, the tree is a base for many immutable functional data structures. For example, if you explore immutable Vector from Scala standard library you will find that it is actually a tree where each node is a small immutable array.

Ghost

Bitcoin automatically adjusts difficulty based on previous history. The goal of this adjustment is a constant block creation rate. For Bitcoin, the target rate is a one new block per 10 minutes. Why 10 minutes? It is an empirically chosen trade-off between latency and security.

Latency characterizes time from request creation to its completion. Or, in other words, a time interval from the moment a user made a payment to the time when other person confirmed that he/she received the payment and he/she is absolutely sure about that fact (at that moment transaction became immutable, or finalized). Generally, low latency is a good thing, but in the blockchain world, it is hard to achieve low latency. For example, common Bitcoin practice is to wait for 5 confirmations before acknowledging payment which is pretty bad latency for buying a coffee (it’s 50 minutes!).

Security was mentioned because high blocks creation rate increases forks probability and forks can reduce security. In order to understand why blocks creation rate affects forks probability, imagine how new blocks propagate through the p2p network:

- A full node receives a new block, validates it and sends to other nodes. There is a transmission delay. And there is processing which happens between receiving and sending of a block.

- There is a distance between nodes. It’s both a geographical distance and a distance in context of the p2p network. It’s common for blocks to travel through intermediate nodes in order to go from A to B.

Points 1 and 2 multiply and you obtain time required to propagate a new block. Two new blocks created during this time interval will cause a fork. How likely it is for miners to independently produce two blocks within fixed time interval and to create a fork? It depends on blocks creation rate. The shorter interval between new blocks, the higher probability to mine block at any point in time. Block propagation time is fixed because it includes networking latency and can’t be reduced. So reducing the time between new blocks increases the probability of forks.

Why are forks bad? First of all, forks make history unstable and Bitcoin’s “5 confirmations” rule exists to tolerate this fact. Also, forks cause orphaned blocks which are blocks rejected in favor of the longest branch, or in other words, unlucky forks. Orphaned blocks don’t contribute to the network security because computational power used to create orphaned blocks is literally wasted. This fact increases chances for an attacker to concentrate enough computational power and to create the fork longer than 5 blocks (and to fool users who thought that 5 confirmations are secure enough for everyone). To clarify this point: imagine that 40% of computational power is wasted to create orphaned blocks. Then an attacker needs only 20+% of computational resources to create 1/3 of useful computational power and to compete with honest miners. 1/3 is because honest miners doesn’t coordinate and there is the analysis which shows that 1/3 portion of computational power and some luck is enough to create useful attacks on Bitcoin.

Ethereum produces new block every 20 seconds (approximately). As a result of that short block creation interval, there is a bigger probability of short living forks. To solve this issue:

- there is “12 confirmations” rule which means transaction finalization time is approximately 3 minutes;

- there is Ghost scheme to increase the security of the network.

Ghost scheme is a simple idea: use orphaned blocks to secure the network. Block creators can reference orphaned blocks in order to increase their own reward and to give some reward to orphaned blocks creators. Orphaned blocks are not used to include new transactions in the blockchain instead they are used to calculate the longest branch (the longest subtree in this case). Hence computational power used to create orphaned blocks is not wasted. And hence short block creation time doesn’t cause the problem described earlier.

Mining puzzle

ASIC is an approach of making specialized hardware to perform a single task which is faster and/or cheaper than general purpose solutions. Mining hardware is a good example of ASICs: specialized hardware computes hashes faster using less energy. It sounds like a good thing: people figured out how to mine new blocks faster using less power. Well, not exactly. Automatic difficulty adjustment makes intervals between new blocks approximately constant regardless of total computational power. So ASICs doesn’t speed up Bitcoin, they

- secure network by increasing computational power

- allow ASICs’ owners to dominate over miners who don’t use ASICs.

Many cryptocurrency theorists consider ASICs to be harmful because ASICs shift mining from individuals to companies. And companies are something that cypherpunk considers to be a bad thing. Ok, not all cryptocurrency users are cypherpunk fans but anyway decentralization is commonly considered as a good thing. However, ASICs cause centralization of mining hence are evil.

To be truly decentralized Ethereum tries to be ASIC resistant and ordinary-user-friendly. From Ethereum wiki: “We try to make it as easy as possible to mine with GPUs”. To do so, they use memory hard puzzle which means solving puzzle requires a lot of fast RAM memory. The key idea is that memory can’t be further specialized to work faster so ASICs should use ordinary memory. That kills the idea of ASICs because commodity hardware with the same amount of RAM will be cheaper than ASIC due to production volumes.

Planned changes

Casper

There are pros and cons for Proof Of Work consensus algorithm. Pros are:

- well studied by scientists and practitioners;

- distributes money (in some sense is achieves fair distribution);

- easy to implement.

Cons:

- has latency limits (i.e. long finalization time);

- consumes a significant amount of electricity.

Latency is a real problem. It’s impractical to buy coffee using Bitcoins because your barista will get tired waiting for transaction completion (not to mention transaction fees). There are several solutions to reduce latency, including alternative consensus algorithms. One of such algorithms is a Proof Of Stake. We will discuss different Proof Of XXX algorithms later, but the key point is that Ethereum authors talk about replacing Proof Of Work with their variation of Proof Of Stake called Casper.

Sharding

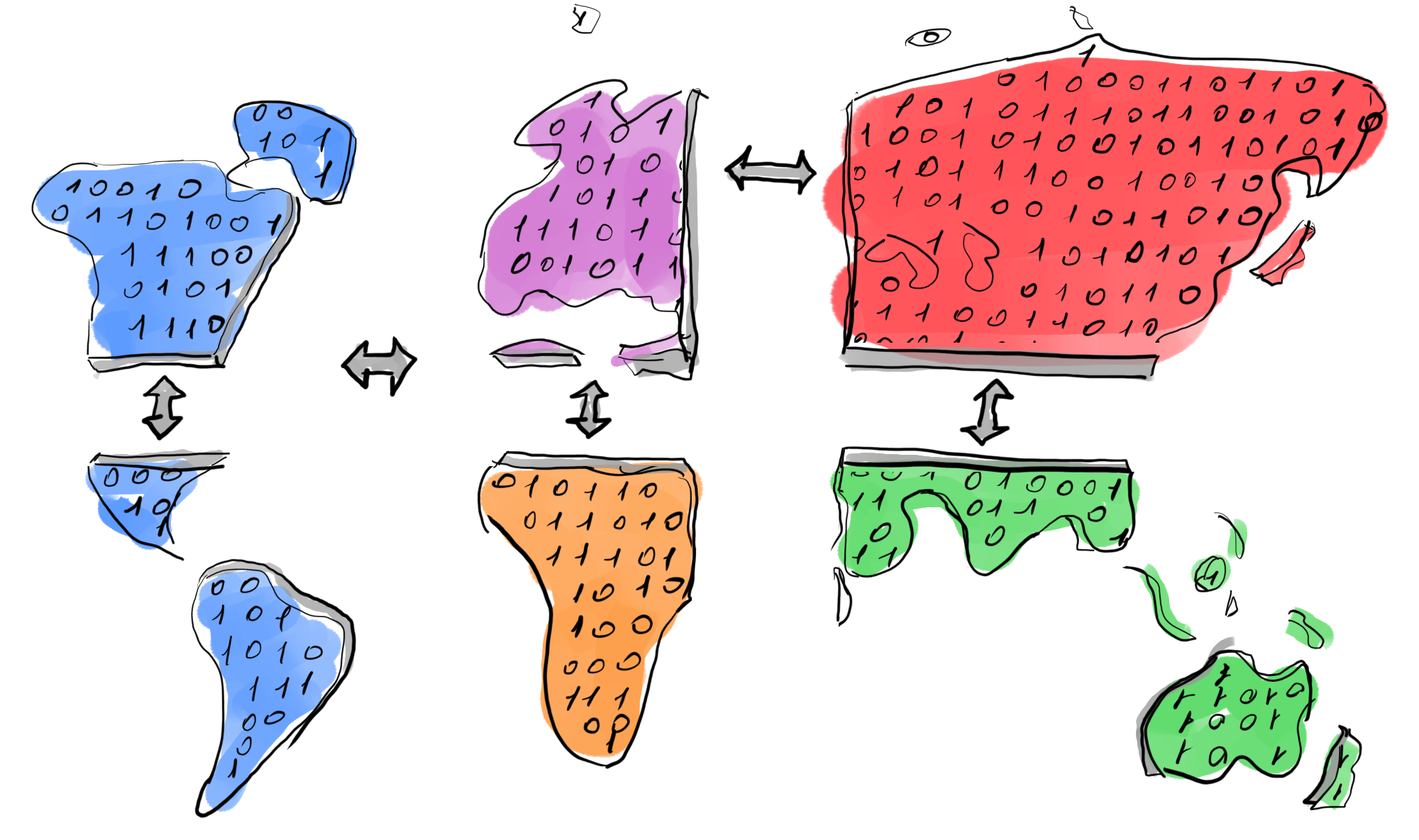

Sharding and replication are bread and butter of a distributed system’s programmer. Replication increases redundancy and it is useful mostly to increase fault tolerance (it also can increase the performance of certain operations). Sharding splits load between different nodes and it is useful mostly to improve the performance of a system. There is no sharding in Ethereum or Bitcoin. And both systems are as redundant as possible. Each full node performs the same tasks:

- stores the whole state;

- validates the whole state;

- telegraphs all transactions and blocks.

Redundancy imposes certain limits on Ethereum and Bitcoin performance. Note that transactions validation in Ethereum requires more computational power than validation in Bitcoin. The throughput of Ethereum is bigger than the throughput of Bitcoin hence its state grows faster. So redundancy is a blessing (it helps to achieve resilience) and a curse (it limits performance) at the same time.

Sharding is a clever solution for reducing redundancy. Just split work into parts and assign different nodes to work on different shards (parts). Sharding raises few important questions:

- which parts of the system to split (state, validation, networking)?

- wherever to make sharding transparent or expose sharding in end-user APIs?

- how to make communication between shard possible?

- how to ensure that attackers can’t leverage sharding for attacks?

Those are hard questions and Ethereum didn’t answer them yet. The only thing I understood from their wiki is that some sort of randomized shuffling can be used to prevent attacks on individual shards. There are also ideas how to organize shards, but no final solution yet (I mean no solution from Ethereum).

Cheatsheet

-

State.

Snapshot of the current state. Stored on all nodes.

-

State transformations.

Transactions, smart contracts. Replayed (and validated) on all nodes.

-

Consensus.

Proof Of Work (with memory hard puzzle and 20s blocks).

Interesting facts

Colorful papers

Each cryptocurrency publishes its white paper which is a formal description of its new algorithms and ideas. Ethereum published the document called the yellow paper instead of a white paper. This is obviously a joke but several other cryptocurrencies did the same thing, so there are a blue paper and a polka dot paper.

Ethereum classic

In 2016 Ethereum team deployed buggy smart contract which was exploited to steal a huge amount of money. As a response to the attack, Ethereum developers made incompatible changes in Ethereum code, fixed buggy smart contract and rolled back transaction which stole money. Technically, incompatible code change and a history revert caused the creation of a new currency which was agreed to be the “true” Ethereum. The old currency with the old history survived and was renamed to Ethereum classic. It’s main idea is that code is a law and what was done shouldn’t be reverted. The event is called the DAO.

To be continued

Finally, I came to a review of ideas from several popular altcoins. Ethereum is most popular altcoin but there are many others! I want to cover several alternative Proof Of XXX algorithms, performance issues, and scaling solutions.

Thanks for reading.